Feie Calculator for Beginners

Table of ContentsFascination About Feie CalculatorThe Of Feie CalculatorFeie Calculator Things To Know Before You Get ThisSome Known Questions About Feie Calculator.What Does Feie Calculator Do?Feie Calculator Can Be Fun For EveryoneSome Known Incorrect Statements About Feie Calculator

If he 'd often traveled, he would rather finish Component III, noting the 12-month period he fulfilled the Physical Existence Test and his travel background. Step 3: Coverage Foreign Earnings (Part IV): Mark earned 4,500 per month (54,000 yearly).Mark determines the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Given that he resided in Germany all year, the percentage of time he resided abroad throughout the tax obligation is 100% and he goes into $59,400 as his FEIE. Mark reports complete earnings on his Kind 1040 and goes into the FEIE as an adverse amount on Schedule 1, Line 8d, decreasing his taxable income.

Selecting the FEIE when it's not the best alternative: The FEIE may not be perfect if you have a high unearned revenue, make greater than the exclusion limitation, or reside in a high-tax nation where the Foreign Tax Obligation Credit Scores (FTC) may be much more helpful. The Foreign Tax Obligation Credit (FTC) is a tax reduction approach commonly used along with the FEIE.

Little Known Questions About Feie Calculator.

expats to counter their united state tax obligation financial debt with foreign revenue taxes paid on a dollar-for-dollar reduction basis. This indicates that in high-tax nations, the FTC can usually remove U.S. tax obligation debt totally. The FTC has restrictions on qualified taxes and the optimum claim quantity: Eligible tax obligations: Only earnings tax obligations (or taxes in lieu of earnings taxes) paid to international governments are eligible (Taxes for American Expats).

tax responsibility on your international earnings. If the foreign tax obligations you paid exceed this limit, the excess international tax obligation can typically be continued for approximately 10 years or returned one year (using an amended return). Maintaining accurate records of foreign income and taxes paid is consequently vital to determining the proper FTC and maintaining tax obligation conformity.

migrants to minimize their tax obligation obligations. As an example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can leave out up to $130,000 making use of the FEIE (2025 ). The continuing to be $120,000 might then undergo tax, yet the united state taxpayer can potentially apply the Foreign Tax Credit scores to balance out the tax obligations paid to the foreign country.

The Basic Principles Of Feie Calculator

He offered his United state home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his partner to aid meet the Bona Fide Residency Test. Neil directs out that purchasing home abroad can be testing without initial experiencing the place.

"It's something that people require to be actually diligent about," he claims, and advises expats to be careful of usual errors, such as overstaying in the United state

Neil is careful to mindful to Tension tax united state tax obligation "I'm not conducting any performing any kind of Service. The United state is one of the few countries that tax obligations its people no matter of where they live, suggesting that even if a deportee has no income from U.S.

About Feie Calculator

tax returnTax obligation "The Foreign Tax Credit permits individuals working in high-tax countries like the UK to offset their U.S. tax obligation responsibility by the quantity they've already paid in tax obligations abroad," says Lewis.

The possibility of lower living prices can be alluring, yet it frequently features trade-offs that aren't right away apparent - https://www.openlearning.com/u/feiecalculator-t03qal/. Real estate, for instance, can be a lot more budget-friendly in some countries, however this can mean endangering on framework, security, or access to reputable utilities and solutions. Affordable buildings may be found in locations with inconsistent net, minimal public transport, or unreliable medical care facilitiesfactors that can dramatically affect your daily life

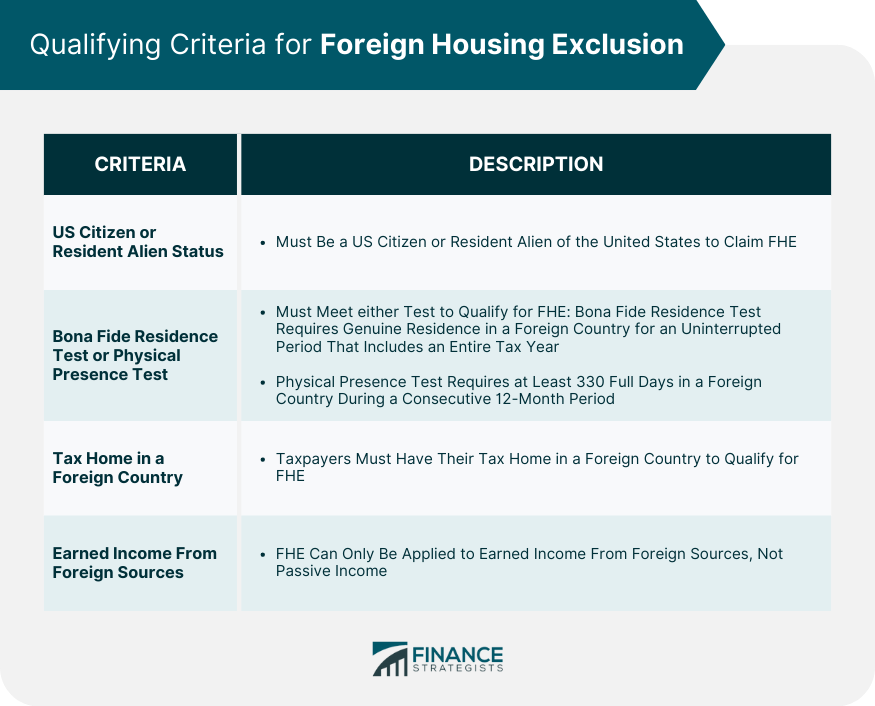

Below are a few of the most frequently asked concerns regarding the FEIE and various other exemptions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to omit up to $130,000 of foreign-earned earnings from government earnings tax obligation, minimizing their U.S. tax obligation responsibility. To get FEIE, you should fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Home Examination (confirm your key home in a foreign nation for an entire tax year).

The Physical Visibility Test additionally needs U.S. taxpayers to have both a foreign earnings and a foreign tax obligation home.

Feie Calculator Things To Know Before You Buy

An earnings tax treaty in between check my source the united state and an additional nation can assist protect against double tax. While the Foreign Earned Earnings Exemption decreases gross income, a treaty might give added advantages for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Record) is a called for declare united state residents with over $10,000 in international economic accounts.

Neil Johnson, CPA, is a tax obligation expert on the Harness platform and the founder of The Tax Dude. He has more than thirty years of experience and now specializes in CFO solutions, equity settlement, copyright taxes, marijuana tax and divorce relevant tax/financial preparation issues. He is a deportee based in Mexico.

The foreign gained revenue exemptions, occasionally referred to as the Sec. 911 exclusions, exclude tax obligation on earnings earned from functioning abroad. The exemptions make up 2 parts - an earnings exclusion and a real estate exclusion. The adhering to Frequently asked questions discuss the advantage of the exemptions including when both partners are deportees in a general manner.

Some Known Factual Statements About Feie Calculator

The tax advantage excludes the income from tax obligation at bottom tax obligation rates. Previously, the exclusions "came off the top" lowering revenue subject to tax obligation at the leading tax prices.

These exemptions do not excuse the wages from US taxes yet just provide a tax decrease. Keep in mind that a solitary individual functioning abroad for every one of 2025 that made regarding $145,000 without any other income will certainly have gross income decreased to absolutely no - efficiently the same answer as being "free of tax." The exemptions are calculated on a daily basis.

If you attended service meetings or workshops in the United States while living abroad, earnings for those days can not be excluded. For United States tax it does not matter where you keep your funds - you are taxed on your around the world income as a United States individual.